Accounting Central

Published date: February 21, 2014

- Location: South Africa

Accounting Central

• Accounting Services

We`ll do the following for you: · Processing work (Processing all your customer and supplier invoices; bank statements; petty cash slips; etc. into your accounting software) · Basic reconciliations (Reconciliation of your bank statements; supplier and customer accounts to third party confirmations) · Complex reconciliations (Reconciliation of your budget to actual results with explanations for large variances) · Preparation of financial statements (Customised management accounts to show you the most significant information to run your business effectively management financial statements for your bank and annual financial statements to present to your shareholders and the Receiver of Revenue (SARS)) · Preparation of reports for submission to SARS and CIPC. · Cash flow forecasts to ensure you don’t run short when expanding your business or replacing your machinery. · Preparation of your budget based on your most recent financial statements and expectations in the short and long term. · Analysis of your financial statements to enable you to identify threats and exploit opportunities. · Development and implementation of internal controls and policies to take some of the weight off management’s shoulders in administering daily business activities. · VAT reviews (We review your financial records and compare them to the source documents identifying transactions on which input VAT was not claimed. We will then assist you to recover the VAT from SARS. We do not charge a fee for the review but work on a commission basis. Our tailor-made customer solutions will ensure that your accounting fee is competitive and focused on your business needs. •Audit/Assurance

A public interest score is calculated for each company or Close corporation on a yearly basis before preparing its financial statements. The public interest score is calculated as follows: Number of points equal to the average number of employees of the company during the financial year One point for R1m (or portion thereof) in third party liability of the company at the financial yearend One point for every R1m (or portion thereof) in turnover during the financial year One point for every shareholder at yearend A company’s financial statements must be audited under the following circumstances: If the public interest score exceeds 350 points If the financial statements are prepared internally or If the company chooses to be audited. A company`s financial statements must be independently reviewed: If the public interest score is less than 350 points; or If the company chooses to have and independent review performed. The Companies Act provides relief to owner managed companies that is companies where all the shareholders are members of the board of directors. An owner managed company need not have its financial statements independently reviewed provided that: The public interest score does not exceed 100 points The financial statements are compiled independently and The company qualifies as an owner managed company. A Close Corporation is subject to an audit under the following

•Engagements and Independent Reviews

•Business Brokerage

•Complance Audits and Secreterial updates

•Business Plan Developments

•Estate Planning

Estate tax (in the instances where your estate exceeds R5 000 000). Transfer duty on your investment property or residential property. Security Transfer Tax (STT) on your shares in companies.

•Monthly Payroll Service

Managing a workforce is an extensive exercise in itself; facing challenges such as: Absconding Calculating PAYE; UIF and SDL Excessive sick leave Fringe benefits Misuse of annual leave Reconciliation of payroll taxes We provide inexpensive solutions without the hassle of acquiring payroll software and appointing an official to manage your payroll. We offer the following services: Preparing your monthly payroll according to your schedule. Submission of monthly EMP201 returns Preparing and distribution of employee payslips via email or printed medium. Submission of IRP5`s Payroll reconciliation and EMP501 Submission of employee tax returns Establishing pay structures to accommodate fringe benefits Quarterly site visits to ensure that your payroll is up to date and compliant with the latest legislation When you subscribe to our payroll services you will receive complimentary leave management on the house. Leave management includes the following: Implementation of policies and procedures to manage your company`s leave cycle Review of your leave cycle to ensure compliance with policies and procedures Maintenance of leave register to ensure your business doesn’t suffer losses due to staff misusing your leave policies Monthly reporting on leave taken and leave balances.

•Taxation Service

• Accounting Services

We`ll do the following for you: · Processing work (Processing all your customer and supplier invoices; bank statements; petty cash slips; etc. into your accounting software) · Basic reconciliations (Reconciliation of your bank statements; supplier and customer accounts to third party confirmations) · Complex reconciliations (Reconciliation of your budget to actual results with explanations for large variances) · Preparation of financial statements (Customised management accounts to show you the most significant information to run your business effectively management financial statements for your bank and annual financial statements to present to your shareholders and the Receiver of Revenue (SARS)) · Preparation of reports for submission to SARS and CIPC. · Cash flow forecasts to ensure you don’t run short when expanding your business or replacing your machinery. · Preparation of your budget based on your most recent financial statements and expectations in the short and long term. · Analysis of your financial statements to enable you to identify threats and exploit opportunities. · Development and implementation of internal controls and policies to take some of the weight off management’s shoulders in administering daily business activities. · VAT reviews (We review your financial records and compare them to the source documents identifying transactions on which input VAT was not claimed. We will then assist you to recover the VAT from SARS. We do not charge a fee for the review but work on a commission basis. Our tailor-made customer solutions will ensure that your accounting fee is competitive and focused on your business needs. •Audit/Assurance

A public interest score is calculated for each company or Close corporation on a yearly basis before preparing its financial statements. The public interest score is calculated as follows: Number of points equal to the average number of employees of the company during the financial year One point for R1m (or portion thereof) in third party liability of the company at the financial yearend One point for every R1m (or portion thereof) in turnover during the financial year One point for every shareholder at yearend A company’s financial statements must be audited under the following circumstances: If the public interest score exceeds 350 points If the financial statements are prepared internally or If the company chooses to be audited. A company`s financial statements must be independently reviewed: If the public interest score is less than 350 points; or If the company chooses to have and independent review performed. The Companies Act provides relief to owner managed companies that is companies where all the shareholders are members of the board of directors. An owner managed company need not have its financial statements independently reviewed provided that: The public interest score does not exceed 100 points The financial statements are compiled independently and The company qualifies as an owner managed company. A Close Corporation is subject to an audit under the following

•Engagements and Independent Reviews

•Business Brokerage

•Complance Audits and Secreterial updates

•Business Plan Developments

•Estate Planning

Estate tax (in the instances where your estate exceeds R5 000 000). Transfer duty on your investment property or residential property. Security Transfer Tax (STT) on your shares in companies.

•Monthly Payroll Service

Managing a workforce is an extensive exercise in itself; facing challenges such as: Absconding Calculating PAYE; UIF and SDL Excessive sick leave Fringe benefits Misuse of annual leave Reconciliation of payroll taxes We provide inexpensive solutions without the hassle of acquiring payroll software and appointing an official to manage your payroll. We offer the following services: Preparing your monthly payroll according to your schedule. Submission of monthly EMP201 returns Preparing and distribution of employee payslips via email or printed medium. Submission of IRP5`s Payroll reconciliation and EMP501 Submission of employee tax returns Establishing pay structures to accommodate fringe benefits Quarterly site visits to ensure that your payroll is up to date and compliant with the latest legislation When you subscribe to our payroll services you will receive complimentary leave management on the house. Leave management includes the following: Implementation of policies and procedures to manage your company`s leave cycle Review of your leave cycle to ensure compliance with policies and procedures Maintenance of leave register to ensure your business doesn’t suffer losses due to staff misusing your leave policies Monthly reporting on leave taken and leave balances.

•Taxation Service

Related listings

-

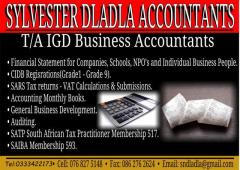

Sylvester Dladla Accounts T/A IGD Business AccountantsAccounting / Bookkeeping Pietermaritzburg (KwaZulu-Natal) June 12, 2018• Financial Statements for Companies, Schools, NPO’s and Individual Business People • CIDB Registrations (Grade 1 - Grade 9) • SARS Tax Returns - VAT Calculations & Submissions • Accounting Monthly Books • General Business Development • Auditing ...

Sylvester Dladla Accounts T/A IGD Business AccountantsAccounting / Bookkeeping Pietermaritzburg (KwaZulu-Natal) June 12, 2018• Financial Statements for Companies, Schools, NPO’s and Individual Business People • CIDB Registrations (Grade 1 - Grade 9) • SARS Tax Returns - VAT Calculations & Submissions • Accounting Monthly Books • General Business Development • Auditing ... -

Precedo Accountants & AuditorsAccounting / Bookkeeping Rustenburg (Gauteng) May 3, 2017• Monthly Bookkeeping • VAT and EMP Returns • Financial Statements • Personal and Business Tax Forms • Payslips and IRP5’s • Tax Clearance Certificates • Letters of Good standing • VAT/ PAYE/UIF Registrations • CC Amendments • PTY Registrations &...

Precedo Accountants & AuditorsAccounting / Bookkeeping Rustenburg (Gauteng) May 3, 2017• Monthly Bookkeeping • VAT and EMP Returns • Financial Statements • Personal and Business Tax Forms • Payslips and IRP5’s • Tax Clearance Certificates • Letters of Good standing • VAT/ PAYE/UIF Registrations • CC Amendments • PTY Registrations &... -

Thalico SolutionsAccounting / Bookkeeping Port Shepstone (KwaZulu-Natal) February 7, 2017Bookkeeping & accounting (Chartered Accountant) Registered with SARS Tax Practitioner Pay Roll Sibco & SAICA Financial Management Tell: 039 621 123 Cell: 073 595 6311 Fax: 039 682 131 Email: thanica@gmail.com

Thalico SolutionsAccounting / Bookkeeping Port Shepstone (KwaZulu-Natal) February 7, 2017Bookkeeping & accounting (Chartered Accountant) Registered with SARS Tax Practitioner Pay Roll Sibco & SAICA Financial Management Tell: 039 621 123 Cell: 073 595 6311 Fax: 039 682 131 Email: thanica@gmail.com